With over a decade of experience in infrastructure investing, our portfolio is designed to offer diversified exposure to rare, high-quality businesses that possess significant competitive advantages and barriers to entry. We leverage our expertise to identify and invest in assets that are not only vital to global economies but also poised for sustainable growth.

Our investments span a broad range of essential services and infrastructure. From facilitating the movement of passengers and freight through toll roads and rail networks to ensuring the efficient distribution of energy and goods via ports and pipelines, our portfolio encompasses critical assets that underpin modern society. Each investment is thoughtfully selected to deliver both long-term value for our stakeholders and measurable contributions to the communities we serve.

More investors are embracing the potential of strategies aimed at improving our collective future, though some worry this might come at the expense of financial performance. At Arco Assets Management, we are unwavering in our commitment to delivering exceptional investment results while driving meaningful change. Our proud legacy reflects a balance of helping clients achieve financial success and positively impacting society.

At the core of our company lies a truly unique ownership structure, unmatched in the industry, that channels a significant portion of our profits toward advancing medical research and societal well-being. This commitment to making a meaningful impact extends beyond our business model—it’s woven into the fabric of who we are.

Company match up to

Supporting medical research

We recognize that our actions extend beyond business—they have the power to create lasting, positive change in the communities we serve. Whether through advancing medical research, supporting environmental sustainability, or fostering social equity, we approach Corporate Responsibility with the same dedication and purpose that define all aspects of our work.

employee match to support social justice organizations

Twice yearly, the Foundation considers grant applications from 501(c)(3) organizations with preference toward those whose work is sustainable, inspires growth and in which our employees have significant and recurring involvement. The Foundation gifts, on average, about $60,000 each year in grants ranging from $500 to $2,500. The Foundation has granted $7.7M since its inception in 2013.

Arco Assets Management Foundation has granted

since 2013

Asset allocation and diversification can help you strike the right balance between risk and return in your portfolio. Holding a broad range of investments can help lessen the impact that any one economic or market event will have on your portfolio. That’s because different investments gain or lose value at different rates and at different times.

Asset allocation refers to the different weightings of stocks, bonds and cash in your portfolio. Because these three asset classes have tended to have varying rates of return and risk profiles, asset allocation plays a role in helping you achieve your investment goal.

Diversification takes this process one step further by spreading your money across different investments within the same asset class. Rather than trying to figure out which type of stock or bond will perform best, you’ll invest in many types. Over time, the ups of one investment have the potential to balance out the downs of another, with the goal of reducing the risk level in your portfolio.

This portfolio is allocated across the three main asset classes. Your asset allocation will depend on your investment goal, time horizon and risk tolerance.

While stocks still have the same percentage allocation, this shows how stocks are now diversified across investments that vary by size and geography.

Spanning four continents, our utilities portfolio benefits from steady, inflation-linked cash flows.

We own and operate port, rail and toll road assets moving freight, bulk commodities and passengers across five continents.

Our energy businesses in North America and Asia Pacific generate stable revenues through long-term contracts with large-scale customers.

District Energy, Canada — Acquired in 2012, our North American district energy systems provide large-scale heating and cooling services to commercial buildings and campuses, benefiting from predictable, inflation-linked cash flows.

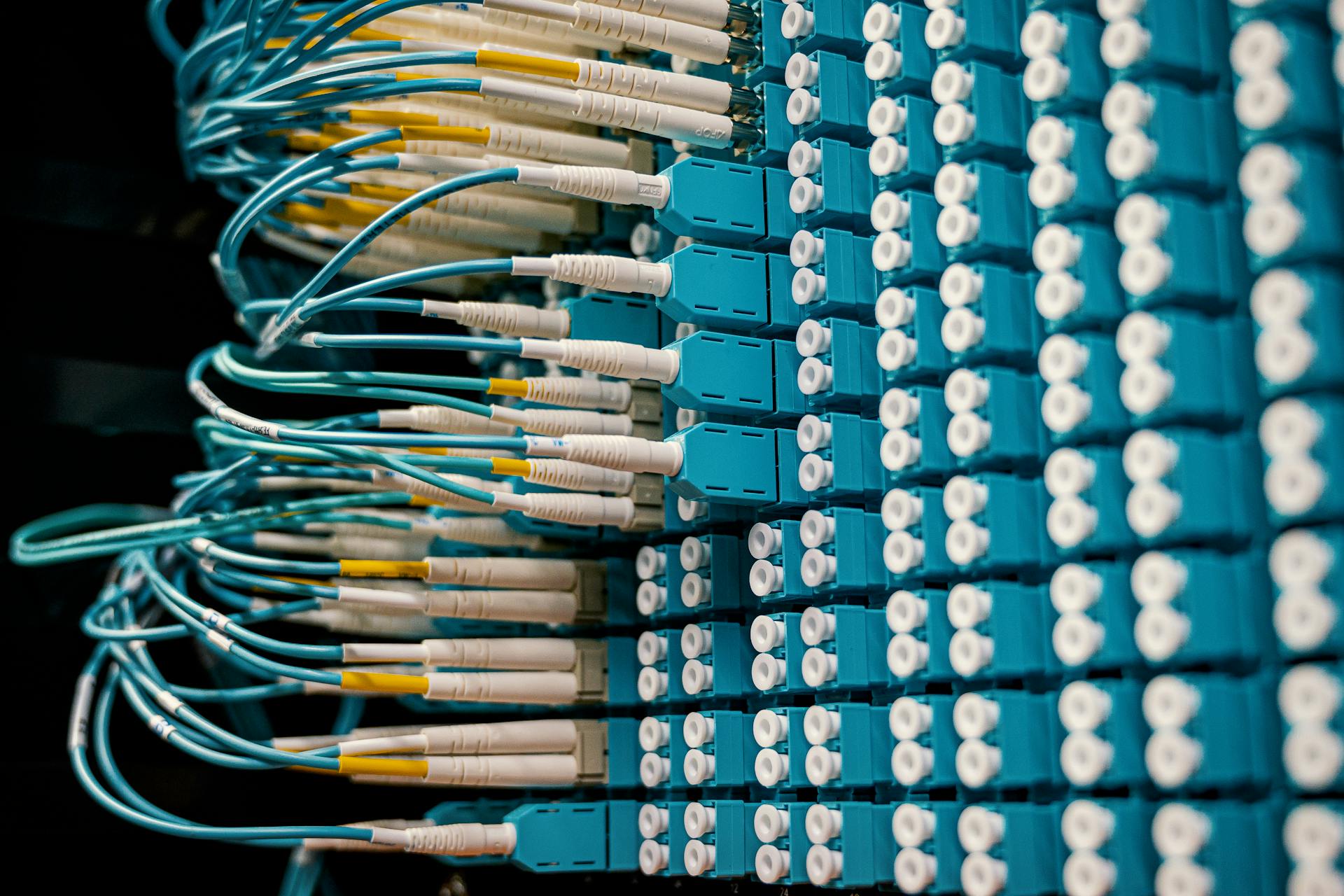

We own and operate businesses that provide essential services and critical infrastructure to transmit and store data globally.

French Telecommunications Infrastructure — In 2015, we acquired an interest in TAF, the largest independent communication infrastructure business in France, which serves the media broadcasting and telecom sectors. With 7,000 towers and rooftop sites and 5,500 km of fiber backbone, TAF is a utility-like infrastructure asset with high barriers to entry. Its growth will be driven by continued site deployments by mobile network operators responding to rising levels of mobile data consumption.

Our 40+ Arco Communities — sometimes called associate resource groups — empower our people to help lift the voices of everyone at Arco Assets Management. Arco Communities are driven by our associates who unite around common experiences and passions, becoming allies for inclusion and equity. Arco Communities represent a rich diversity of identities and interests, including race/ethnicity, gender identity, sexual orientation, faith, mental health and much more. The list is always growing, as our employees raise their hands to create new Communities for our people to connect.